Early on, the C-suite perceived cloud adoption in insurance mostly as a cost-cutting measurea cost-effective means of streamlining operations and minimizing the use of physical infrastructure. But as insurers have tapped the full power of the advantages of cloud computing, they're beginning to see that its advantages extend way beyond mere cost savingsthere's a lot more involved.

The Cloud as a Catalyst for Operational Profitability

Let's get into the numbers, which reveal the real story. According to a recent McKinsey analysis, by 2030 cloud adoption has the potential to drive an EBITDA run-rate impact of $70 billion to $110 billion in the insurance industry alone. To put that in perspective, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a measure of a company's underlying profitabilitybasically, how well it performs without considering outside things like taxes or maintenance expenses.

This is where the cloud really pays off for insurers. It's not a technology upgradeit's an operational efficiency enabler that makes streamlined processes into hard cash. As a matter of fact, cloud use can be responsible for 43-70% of all total EBITDA effect across all sectors, which highlights the heavy financial gain for insurers. This implies faster claim settlement, more sophisticated data analytics, and enhanced customer engagementall without reducing expenses associated with running legacy infrastructure.

If you stop to consider it, the advantages of cloud computing is not only about cost savings for insurers; it's also about creating new revenue streams. This change is one that cannot be overlooked in the competitive market of today.

Cloud Strategy: Powering the Engine of Insurance Innovation

The cloud has evolved from its early days as an operational enabler to become the driver of breakthrough innovations in the insurance sector. It's the environment where innovative technologies such as AI-driven underwriting, real-time risk modeling, and dynamic pricing models flourish. What's distinctive is the way the cloud redefines scalabilitynot just processing data, but also enabling insurers to test, iterate, and roll out game-changing technologies at unprecedented speed, making bold innovations feasible and scalable across global markets.

The insurance market is no longer controlled by a handful of legacy players. The cloud is now at the center of this disruption, with traditional insurers and insurtech companies forming partnerships to change the shape of the industry. It is no longer about backing IT infrastructure; the cloud is now the prime enabler of mass disruption in the industry.

Global Cloud Computing Market for SaaS and PaaS

Following are some of the standout examples of how cloud strategies are driving innovation:

Driving Agility in an Era of Rapid Change

Agility is now the defining edge of competitiveness for the insurance sector. Those days of slow, clunky processeslong policy updates, hardware dependency, and complicated data migrationsare giving way to unheard-of speed and agility, courtesy of cloud technology.

For instance, American Family Insurance's cloud collaboration with Amazon Web Services (AWS) in 2022 facilitated its cloud migration at a faster pace, allowing the company to create and introduce new insurance products, including usage-based insurance (UBI) programs, at a quicker pace. This strategic initiative empowered American Family to innovate at a faster pace and strengthen its digital capabilities.

In addition, the scalability of the cloud enables insurers to pilot and implement solutions on a global or national basis without the huge initial expenses previously associated with global expansion.

Cloud Adoption: Facilitating Global Scalability for High-Value Solutions

Global scalability is no longer a fantasy for insurers but a reality, as cloud technology enables insurers to have the infrastructure to expand their solutions effortlessly across borders.

Consider Chubb, for instance. The insurer deployed a cloud-native platform to scale its cyber insurance offerings globally. By processing enormous amounts of localized regulatory information in real-time, Chubb was able to deploy region-specific cyber policies across continents with ease. Such global scalability has made Chubb a market leader in mitigating the new risks of the digital-first economy.

Quantum Computing in Insurance: The Next Innovation Frontier

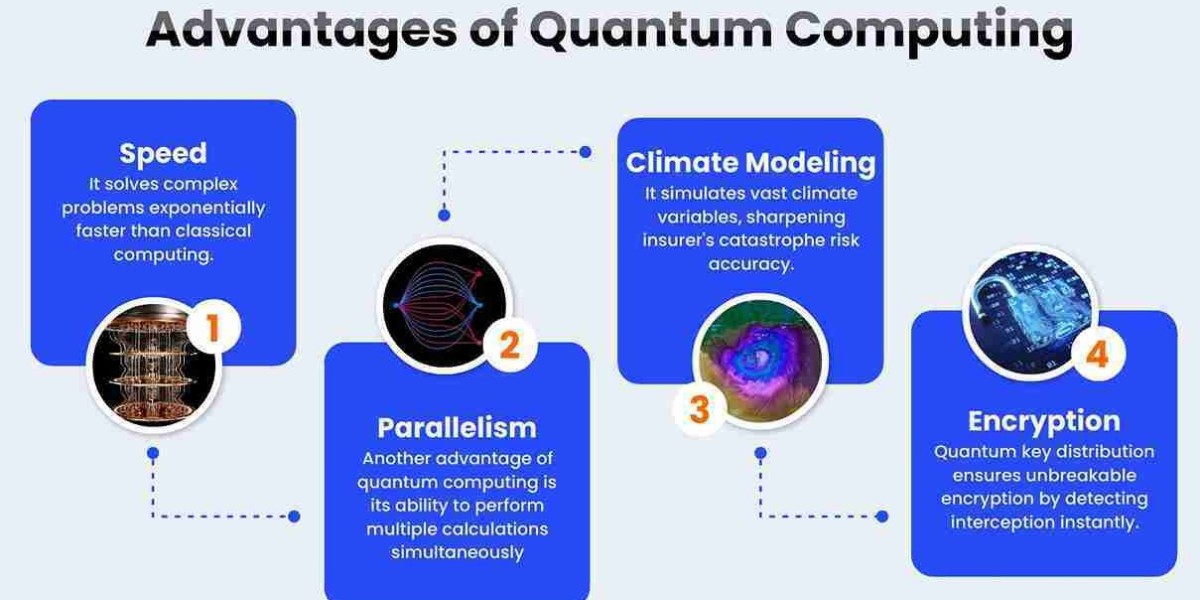

Yet another important advantages of cloud computing is its contribution towards getting insurers ready for the age of quantum computing. Forward-thinking insurers are already investigating quantum-capable environments, offered by cloud platforms, in order to try out quantum-proof encryption algorithms. Apart from reinforcing security, quantum computing has revolutionizing potential to address intricate insurance challenges like portfolio optimization, risk modeling, and fraud detection that classical computers can simply not cope with.

What is Quantum Computing?

Quantum computing represents a step above processing capabilities, employing quantum bits (qubits) in lieu of binary bits. Owing to quantum processes such as superposition (in which qubits can contain 1 and 0 simultaneously) and entanglement (where qubits become connected regardless of distance), quantum computers have the ability to compute enormous datasets concurrently. As such, they are able to address problems that it would take normal computers years, or even centuries, to work on.

Why Quantum Computing Will Power Insurance Innovation

Quantum computing will transform insurance by making it possible to solve complex processes faster and more accurately:

Faster Risk Modeling and Pricing: Conventional risk analysis is based on complex models that need huge computational power. Quantum computers can handle millions of variables and scenarios simultaneously, allowing real-time risk modeling, better pricing, and customized policies.

Optimized Portfolio Management: Quantum computing has the potential to maximize investment planning for insurers, who typically rely on managing big portfolios. Quantum systems are able to rapidly scan for optimal investment options and reduce risks, enabling insurers to optimize returns while maintaining stability in finances.

Fraud Detection at Scale: Given that fraud costs the industry billions of dollars a year, quantum computing brings a game-changing benefit by analyzing massive amounts of data to detect patterns which other systems may miss.

Unleashing the Power of Insurtech Alliances

Insurers are finding more and more that they're looking to use insurtech alliances to maximize and diversify their products. More than 80% of insurers, writes The Geneva Association, are currently working with tech companies to construct digital ecosystems.

The transition from internal development to partnership with insurtechs is a strategic decision. It eliminates the expense and time invested in developing systems internally and enables insurers to be proactive and at the forefront by leveraging the latest technology.

As the industry evolves further, it's evident that cooperation among legacy insurers and insurtech professionals is a driving force behind unlocking new heights of efficiency and innovation. For insurers, doing everything on their own is no longer a question anymoreit's about how to partner with the appropriate technology vendors to be competitive in a continuously changing environment.