SPARK Matrix™ Analysis: The Strategic Role of CECL in Financial Institutions

QKS Group’s market research on Current Expected Credit Loss (CECL) provides a comprehensive global analysis, examining both short-term and long-term market growth opportunities, evolving trends, and future market dynamics. The study offers a detailed market forecast, highlighting adoption rates and growth trajectories across different regions and industries. It serves as a valuable strategic resource for technology providers to deepen their understanding of the market landscape and align their product and growth strategies accordingly. Additionally, it equips financial institutions and other users with critical insights to assess vendor capabilities, competitive positioning, and differentiation in a rapidly evolving regulatory environment.

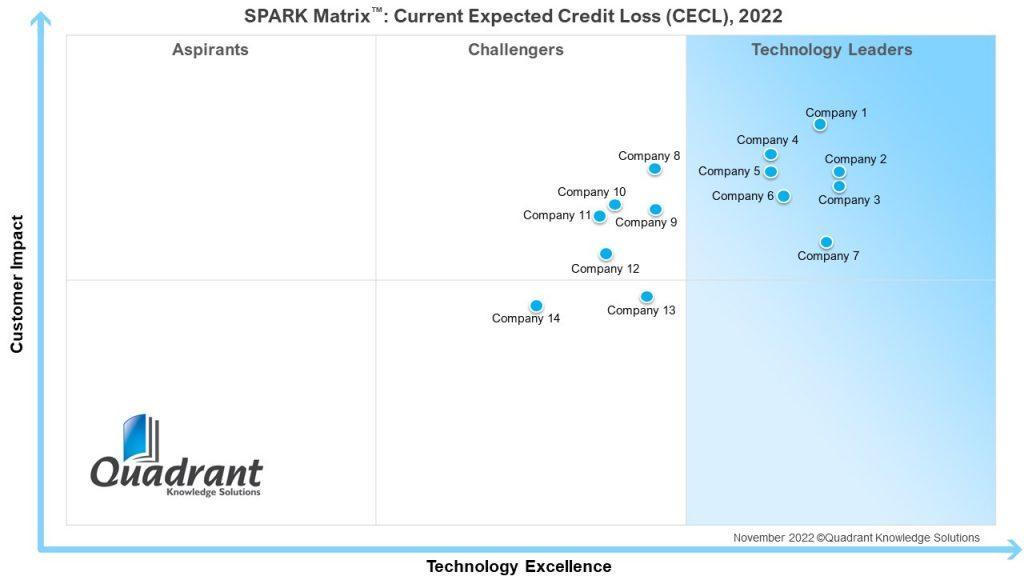

A central component of this research is the proprietary SPARK Matrix analysis, which delivers an in-depth competitive assessment and vendor evaluation. The SPARK Matrix framework ranks and positions leading CECL solution providers based on technology excellence and customer impact, offering a clear view of their market standing on a global scale. The report features a detailed evaluation of prominent vendors, including Abrigo, Adenza, Bloomberg, FICO, Fiserv, Jack Henry & Associates, MIAC, MORS Software, Moody’s Analytics, Oracle, RiskSpan, SAS, SS&C Technologies, and Wolters Kluwer.

According to Senior Analyst at QKS Group, “A CECL solution plays a critical role in automating the complex credit loss accounting process by delivering accurate loss estimations and forward-looking forecasts. These solutions enable banks, financial institutions, lenders, and regulatory bodies to seamlessly implement CECL methodologies while ensuring compliance with regulatory standards. Modern CECL platforms leverage advanced technologies such as artificial intelligence and machine learning to integrate and process large volumes of diverse data, combining historical records with real-time market conditions. This advanced analytical capability enhances the precision of credit loss predictions, reduces operational complexity, and supports organizations in effectively managing credit and market risk.”

As financial markets become increasingly dynamic and regulatory frameworks continue to evolve, the demand for intelligent and automated credit loss estimation tools is rapidly growing. CECL solutions not only support compliance with accounting standards but also empower organizations with predictive insights that drive more informed decision-making. By integrating CECL platforms with enterprise risk management systems, financial institutions can gain a unified view of credit exposure, optimize loan portfolio strategies, and enhance capital planning processes. Furthermore, the ability to conduct scenario analysis and stress testing in real time allows organizations to proactively address potential vulnerabilities, improving both operational resilience and financial stability.

#Current Expected Credit Loss (CECL) #CECL solutions #CECL compliance

#CECL software vendors #CECL #CreditRisk #RiskManagement